Tech. blogs and financial news networks are buzzing about blockchain, a cryptographic, distributed trust technology. The key innovation is how it reduces the need for central third-party institutions to serve as central authorities of trust — banks, courts, large corporations, stock markets and even governments, for example.

Distributed trust enables co-operative forms of organization without a centre. It can distribute power away from centralized institutions to those that traditionally have less power. Such powerful institutions do not let go of their influence easily.

The ongoing debate about how to regulate distributed trust technologies assumes that the advocates of the technologies will seek both legal status and enforceability. Scholars propose that such developments in distributed trust are a competitive threat to nation-state paper currencies.

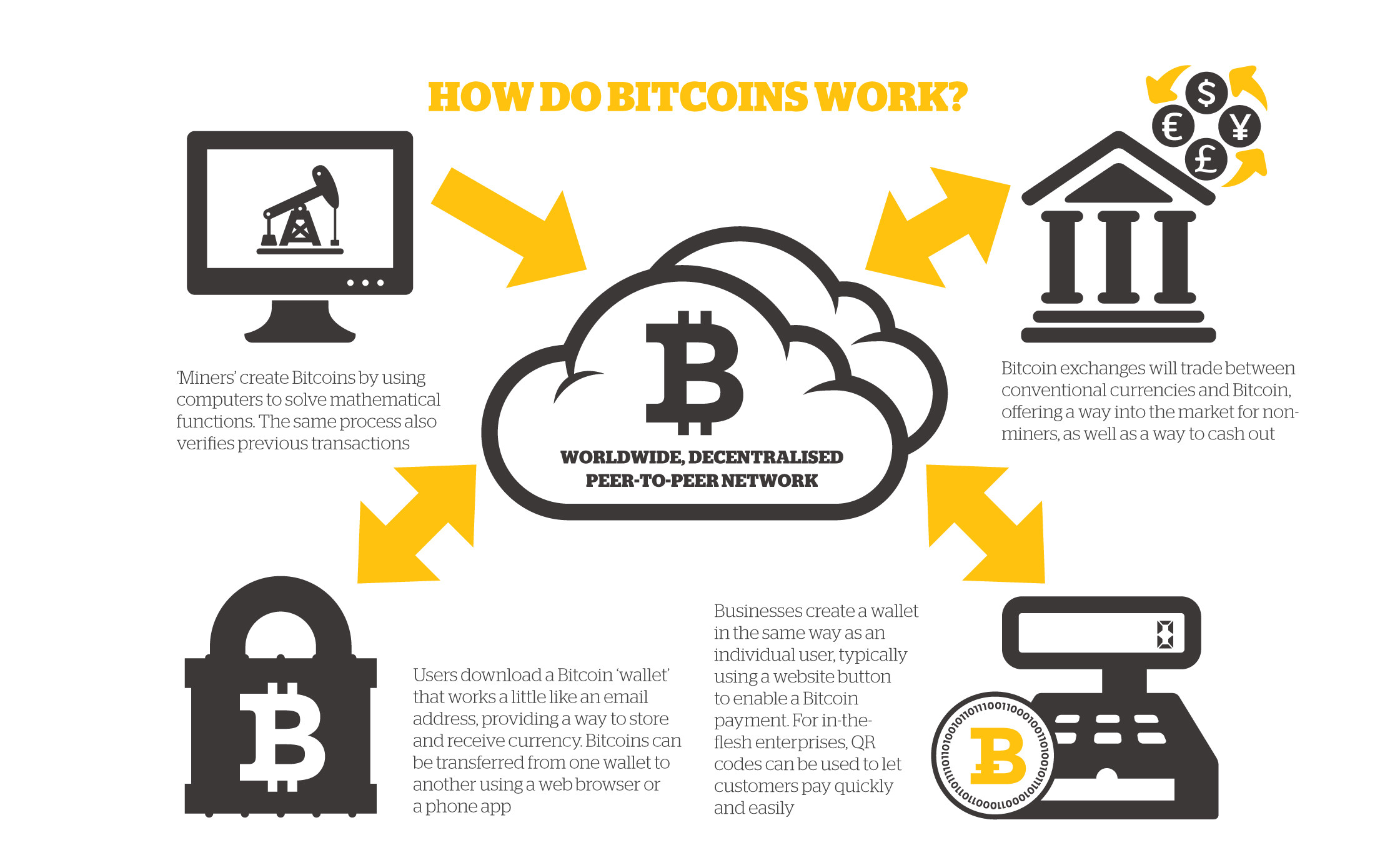

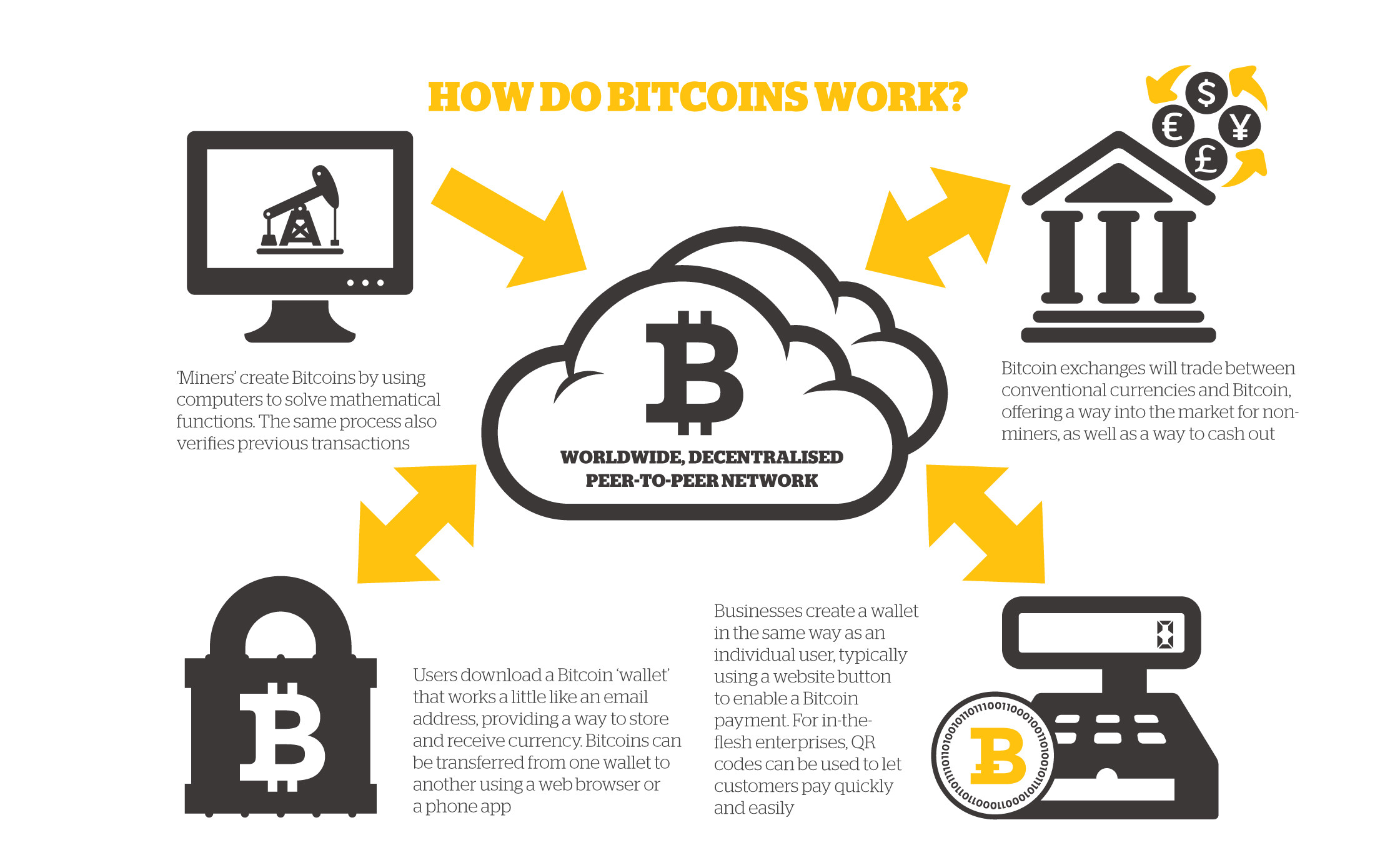

Bitcoin vs. banks

Regulators are struggling to deal with a fundamental shift in market structure. National central banks are implementing policies to keep control and regulate distributed trust technology.

For example, the Chinese government has banned several types of distributed trust activities, and is launching its own non-distributed, centralized digital currency.

The Japanese government has made Bitcoin a legal payment method, and major Japanese banks are planning to launch a J-Coin digital currency pegged to the Yen which may be built on a blockchain.

Russia initially treated non-approved currency trades as illegal, but is now determining how to regulate them.

In fact, traditional centralized, powerful organizations like banks, governments, regulators and technology behemoths are all spending billions figuring out how to use and control distributed trust technologies.

Source: WEF